Introduction

In today’s interconnected digital and financial environment, abbreviations and acronyms often carry multiple meanings depending on context. One such term is DPSIT, which has been interpreted in different ways—from shorthand in finance to the name of an international IT services company, and even as an emerging concept linked to digital payment security. While the letters may look simple, DPSIT reflects the evolving relationship between technology, money, and data. By unpacking its meanings and real-world relevance, we gain insight into how acronyms like this shape conversations across industries.

DPSIT as a Shorthand for Deposits

In financial contexts, dpsit is often used as a casual abbreviation for deposits. This shorthand sometimes appears in handwritten notes, informal ledgers, or even in digital finance communication where brevity is key. Though it may not be a standardized accounting term, its meaning is clear: it points to money placed into an account for safekeeping or future transactions.

Deposits—whether savings, term deposits, or cash lodged into checking accounts—are the backbone of the banking system. Seeing DPSIT as shorthand highlights the way ordinary people simplify complex systems into manageable, everyday language.

Also Read: Application Mobile DualMedia: Redefining Mobile Development with Multimedia Integration

DPSIT as an IT Solutions Company

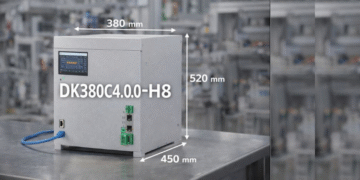

Beyond finance, DPSIT is also the name of an IT consultancy operating in Sweden and Saudi Arabia. This company focuses on delivering services such as data protection, cybersecurity, cloud solutions, backup and disaster recovery, and infrastructure support. In an era where organizations face constant digital threats, the work of firms like DPSIT is essential.

Consider a hospital that must secure sensitive patient data or a retail chain that depends on uninterrupted access to its payment systems. IT service providers like DPSIT create the secure frameworks that allow these institutions to function smoothly while minimizing the risks of data breaches or system outages.

DPSIT and Digital Payment Security

Another way the acronym is interpreted is as Digital Payment Security & IT. This reflects a growing field that emphasizes protecting online transactions in a digital-first world. With the rise of e-commerce, mobile wallets, and global financial platforms, securing payments has become as important as the transactions themselves.

Fraud, phishing, and identity theft are constant threats. DPSIT, in this sense, is about creating safeguards through encryption, two-factor authentication, AI-driven fraud detection, and secure payment gateways. The concept underscores how technology and finance increasingly merge, demanding professionals who understand both domains.

Why DPSIT Matters Today

Whether understood as deposits, an IT company, or digital payment security, DPSIT reflects larger themes: trust, protection, and connectivity. In finance, deposits are a matter of trust between customer and bank. In IT services, trust lies in securing infrastructure and data. And in digital payment systems, trust ensures that money moves safely across invisible digital networks.

The recurring thread is confidence—people, businesses, and institutions all need assurance that their money, data, and systems are safe. DPSIT, in any of its meanings, symbolizes the structures that make that assurance possible.

Also Read: Snowbreak Locate Uninterruptible Power Supply (UPS): A Comprehensive Guide

Conclusion

DPSIT is more than a string of letters—it is a multifaceted concept that links the security of money, data, and digital infrastructure. Whether you encounter it as shorthand for deposits, as the name of a growing IT consultancy, or as a broader idea tied to digital payment security, it points to the ways modern life depends on safe, reliable systems. As technology continues to reshape finance and business, the principles behind DPSIT—security, clarity, and trust—will only grow in importance.

FAQs

1. What does DPSIT mean in finance?

In financial shorthand, “dpsit” is often used as an abbreviation for deposits, referring to money placed into a bank account.

2. Is DPSIT an IT company?

Yes, DPSIT is also the name of an IT services provider operating in Sweden and Saudi Arabia, offering solutions in data protection, cybersecurity, and cloud infrastructure.

3. What is DPSIT in the context of payments?

In payment technology, DPSIT is sometimes interpreted as Digital Payment Security & IT, emphasizing secure financial transactions and protection against cyber threats.

4. Why is DPSIT important in today’s world?

Because it reflects the growing need for trust and security in both finance and technology, ensuring deposits are safe, data is protected, and digital payments are reliable.

5. Is DPSIT widely recognized?

It is not a universally standardized term, but it appears in different contexts—banking shorthand, company branding, and payment security discussions—each highlighting its relevance.