Introduction

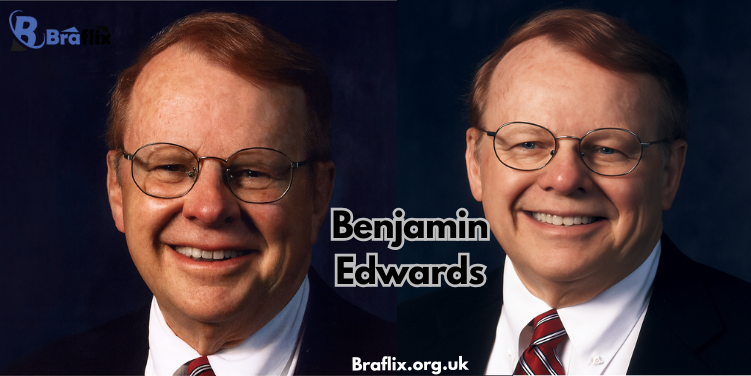

Benjamin Edwards is a name that carries a legacy in the world of finance and wealth management. Known as part of a five-generation lineage tied to the Edwards family, he has become associated with trust, innovation, and commitment in financial services. From the early foundations of A.G. Edwards to the establishment of Benjamin F. Edwards, his name represents not only financial success but also the struggles and pressures that come with carrying a historic legacy.

His journey, marked by both positive achievements and negative challenges, provides lessons in leadership, client service, and the ability to adapt in a rapidly evolving industry. This article explores his biography, contributions, values, and the key insights one can draw from his career.

Quick Bio

| Attribute | Details |

|---|---|

| Full Name | Benjamin F. Edwards (Business Legacy) |

| Profession | Finance Leader, Wealth Management Executive |

| Known For | Legacy in A.G. Edwards & Benjamin F. Edwards Inc. |

| Family Legacy | Part of the five-generation Edwards family in finance |

| Core Strengths | Leadership, Client Service, Innovation |

| Focus Areas | Wealth Management, Investment Advisory, Client Relations |

Early Life and Family Legacy

Benjamin Edwards was born into a family with deep financial roots. The Edwards family name has been tied to finance since 1887, when Albert Gallatin Edwards founded A.G. Edwards in St. Louis. Growing up in this environment meant that Benjamin was surrounded by discussions of trust, financial strategy, and client service.

This strong family heritage instilled in him the values of hard work, discipline, and integrity. While these values offered positive guidance, they also brought a certain pressure. Carrying a famous family name in finance meant living with constant expectations, both from within the family and from the industry at large.

Also Read: Pat Gordon-Smith: Inspiring Editor and Creative Voice

Career Path in Finance

Benjamin Edwards followed in the footsteps of his family by contributing to the financial services sector. His professional journey has been shaped by years of dedication to clients, wealth management strategies, and leadership roles that reflect the strength of the Edwards brand.

He became most closely associated with the establishment and growth of Benjamin F. Edwards & Co., a financial firm designed to uphold family traditions while also embracing modern approaches to investment. This was a positive step in carrying forward the legacy, yet it came with the negative challenge of standing out in a crowded financial industry dominated by large corporations.

Founding of Benjamin F. Edwards & Co.

The creation of Benjamin F. Edwards & Co. was a significant milestone. Built on the core values of trust, mutual respect, and client-first service, the firm sought to continue the Edwards tradition while adapting to new demands in financial management.

The positive element of this achievement was the successful expansion of the company across multiple states, establishing numerous branches and attracting experienced financial advisors. However, the negative side was the difficulty of competing with global financial giants that had greater resources, more technology, and wider networks. Despite these challenges, the company thrived through personal connections and its emphasis on relationships.

Positive Contributions to Finance

Benjamin Edwards’ contributions have been widely recognized. He helped restore the focus on client relationships at a time when much of the industry was becoming impersonal and dominated by algorithms. His emphasis on trust, education, and personalized advice redefined wealth management for many individuals and families.

The positive legacy also includes his role in preserving values of honesty and integrity within the company. These principles not only benefited clients but also inspired financial advisors who joined the firm. His ability to merge family tradition with modern innovation became a hallmark of his leadership style.

Negative Challenges in the Industry

The financial world is never without difficulties. Benjamin Edwards and his firm faced challenges from regulatory changes, market volatility, and increased competition. The industry shifted towards digital tools and large-scale platforms, creating difficulties for smaller firms that relied on traditional models of personal service.

The negative challenges also extended to maintaining independence in a market dominated by mergers and acquisitions. Yet, instead of surrendering to these pressures, Benjamin Edwards and his company adapted. They blended traditional relationship-based service with carefully chosen modern technologies to stay relevant in the changing landscape.

Leadership Style and Values

Benjamin Edwards has always emphasized a leadership style grounded in values. He believes in empowering advisors with independence, encouraging teamwork, and prioritizing client success above all else. This approach reflects the positive side of servant leadership—guiding others by placing their needs first.

The values of integrity, respect, and perseverance remain at the core of his leadership. While some critics might argue that such traditional values can be difficult to maintain in a hyper-competitive environment, they have proven to be a steady foundation that sets his company apart.

Impact on Clients and Advisors

For clients, Benjamin Edwards represents stability, trust, and guidance in financial planning. His firm’s advisors are known for building long-term relationships, focusing on education, and ensuring that clients feel supported in every financial decision.

For financial advisors, the company culture emphasizes autonomy and professional growth. Advisors are encouraged to shape their own practices while benefiting from the supportive structure of the firm. The positive impact has been the creation of a loyal network of professionals who value both independence and collaboration.

Future Outlook and Legacy

Looking ahead, the Edwards legacy in finance is expected to continue through innovation, client-centered service, and adaptability. The foundation built by Benjamin Edwards has already inspired a new generation of leaders and advisors within the company.

The future, however, is not without risks. Financial markets are unpredictable, and competition is fierce. Yet the strength of the Edwards legacy, combined with the ability to evolve, positions the firm for continued relevance. The balance of tradition and innovation will define its success in the coming years.

Also Read: Mark Herrema: Visionary Leader Turning Greenhouse Gases into Sustainable Solutions

Conclusion

Benjamin Edwards represents both the strength and the challenge of carrying a historic legacy in finance. His leadership at Benjamin F. Edwards & Co. shows how values like trust, respect, and integrity can remain powerful in an industry dominated by change.

The positive aspects of his journey include building relationships, expanding the family legacy, and inspiring a culture of honesty in finance. The negative aspects involve industry pressures, competition, and the constant challenge of maintaining independence. Together, these elements make Benjamin Edwards an influential figure whose story offers timeless lessons for leaders and professionals alike.

FAQs

Q1: Who is Benjamin Edwards?

Benjamin Edwards is a finance leader connected to the Edwards family legacy, best known for his role in wealth management and the creation of Benjamin F. Edwards & Co.

Q2: What is Benjamin F. Edwards & Co.?

It is a wealth management firm founded to continue the Edwards family tradition of client-first financial service while embracing modern investment practices.

Q3: What are Benjamin Edwards’ leadership values?

His leadership emphasizes trust, integrity, mutual respect, and empowering financial advisors to serve clients independently.

Q4: What challenges has he faced in finance?

He has dealt with market volatility, industry consolidation, and the competition of larger global firms, while striving to maintain independence and personal service.

Q5: Why is Benjamin Edwards’ story important?

It highlights the balance of tradition and innovation in finance and offers lessons in resilience, leadership, and values-based business practices.