Introduction

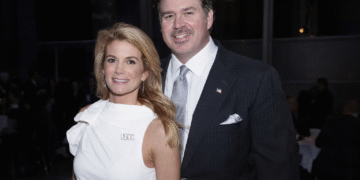

Footballer Tom Cairney, captain of Fulham FC, recently made headlines — not for his performance on the pitch but for a surprising off-field issue. The midfielder was fined £7,692 by the DVLA after unknowingly driving a vehicle that wasn’t properly taxed. What made the situation stand out was the small amount involved — just £2.92 of unpaid car tax led to an eye-watering penalty.

This incident quickly became a topic of public debate, sparking discussions about fairness, responsibility, and how strict enforcement laws can sometimes seem disproportionate. Beyond the headlines, however, lies a valuable lesson for every motorist about the importance of staying up to date with vehicle excise duty and understanding the DVLA’s rules.

Quick Bio

| Attribute | Details |

|---|---|

| Full Name | Tom Cairney |

| Profession | Professional Footballer |

| Current Club | Fulham FC |

| Position | Midfielder / Captain |

| Born | January 20, 1991, Nottingham, England |

| Known For | Leadership at Fulham, technical ability, and community involvement |

| Recent News | Fined £7,692 by DVLA for unpaid car tax of £2.92 |

| Legal Context | Breach of Vehicle Excise Duty laws in the UK |

Tom Cairney’s DVLA Fine Explained

In late 2024, Tom Cairney faced a DVLA fine after it was discovered that his vehicle’s road tax had expired. Records showed that his car tax ran out on September 19, 2024, and the vehicle was detected as untaxed on October 26, 2024. Although the amount owed was minimal — just £2.92 for the missed days — the fine was severe, reflecting the legal seriousness of using an unlicensed vehicle on public roads.

Cairney reportedly admitted that he had “completely forgotten” to renew the tax, pleading guilty through a Single Justice Procedure, a legal process used for minor offences that allows cases to be handled without a full court appearance. The judge imposed a fine of nearly £7,700, including court fees and other charges. While the footballer accepted full responsibility, the incident raised eyebrows due to the striking imbalance between the tax owed and the penalty issued.

Also Read: Georgiana Bronfman: The Graceful Woman Behind Fame, Fortune, and Controversy

Understanding the DVLA’s Vehicle Tax Rules

Every car on UK roads must have valid Vehicle Excise Duty (VED) unless it has been declared off-road (SORN). This rule applies to all motorists, regardless of income, status, or intention. Even a single day of expired tax can lead to enforcement action.

The DVLA uses Automatic Number Plate Recognition (ANPR) cameras to detect untaxed vehicles instantly. Once identified, fines are automatically issued. The penalty can range from a fixed amount to a much larger court fine, depending on the circumstances and whether it is a repeat offence. Cairney’s case demonstrates that even small administrative errors can lead to substantial consequences.

Why the Fine Was So High

Many people questioned how a £2.92 tax issue could escalate into a £7,692 fine. The answer lies in how the courts calculate penalties. Under UK law, fines are not tied directly to the amount owed but rather to the offence itself and the offender’s income level.

As a Premier League footballer, Cairney’s reported earnings influenced the size of the penalty. The Single Justice Procedure takes into account a person’s income when issuing fines, aiming to make punishments proportional to financial capacity. While fair in principle, this system often produces headlines when applied to high earners, as even small infractions lead to significant sums.

Public Reaction: Fair or Excessive?

The public response was divided. Many people sympathized with Cairney, arguing that the punishment was disproportionate to the offence. Social media users highlighted that an oversight worth less than £3 resulted in a penalty of thousands — calling it a “technicality turned punishment.”

Others, however, supported the DVLA’s firm stance, emphasizing that responsibility applies to everyone, regardless of fame or fortune. They pointed out that car tax enforcement ensures fairness on the roads and helps fund public infrastructure. The case became a reminder that celebrity status doesn’t grant immunity from everyday laws.

Legal Insight: The Role of the Single Justice Procedure

Cairney’s case was handled under the Single Justice Procedure (SJP) — a fast-track legal process used for minor offences such as speeding, unpaid tax, or parking violations. It allows defendants to plead guilty or not guilty by post, without physically appearing in court.

While this system reduces administrative pressure on the courts, critics argue it lacks transparency. High-profile cases like Cairney’s reignite discussions about whether fines determined through the SJP process should consider context more carefully, especially for first-time or accidental offenders.

Lessons for Drivers: Avoiding a Similar Situation

Always Renew Vehicle Tax on Time

Set calendar reminders or enable auto-renewal for your car tax. The DVLA sends renewal notices, but relying solely on post or email can lead to accidental oversights.

Use SORN if You’re Not Driving

If your car is unused or parked on private property, file a Statutory Off Road Notification (SORN). This officially exempts you from paying road tax until the vehicle is back in use.

Verify Payment Confirmation

Sometimes, card issues or technical errors can cause failed payments. Always confirm successful tax renewal and keep documentation.

Respond Quickly to Notices

If you receive a DVLA warning, act immediately. Paying quickly can prevent escalation into a formal prosecution and large fines.

The Bigger Picture: Responsibility and Regulation

The Tom Cairney DVLA fine highlights how digital systems now enforce laws more efficiently but sometimes rigidly. Automated detection and income-based fines aim to make justice fairer, yet they can feel harsh when intent was absent.

For motorists, the takeaway is clear — compliance with road regulations is not optional, and the margin for error is narrow. For lawmakers, cases like this provoke discussion about striking the right balance between deterrence and fairness.

Tom Cairney’s Response and Reputation

Despite the fine, Tom Cairney has remained professional and composed. Known for his leadership both on and off the pitch, he accepted responsibility and did not attempt to deflect blame. His swift acknowledgment of the error demonstrates humility — a quality admired by fans and peers alike.

While the incident caused temporary headlines, it’s unlikely to overshadow his footballing career. Cairney continues to serve as Fulham’s captain, admired for his discipline, sportsmanship, and consistency.

Also Read: Mike Dobinson: The Inspiring Life, Love, and Journey of a Private Yet Remarkable Man

Conclusion

The Tom Cairney DVLA fine story serves as both a cautionary tale and a public reminder. A seemingly minor mistake — forgetting to renew car tax — can result in major financial penalties. While many view the punishment as excessive, the law applies equally to everyone, and enforcement remains uncompromising.

For drivers, the lesson is simple: stay alert, stay compliant, and treat even small administrative tasks with care. For Cairney, this episode reinforces that no one, regardless of success or status, is above the law — but also that accountability and integrity define character more than circumstance.

Frequently Asked Questions (FAQ)

Who is Tom Cairney?

Tom Cairney is a professional footballer and captain of Fulham FC, known for his leadership, technical skill, and long-standing contribution to the club.

Why was Tom Cairney fined by the DVLA?

He was fined for driving a vehicle with expired car tax. The unpaid amount was £2.92, but the penalty was £7,692 due to legal and income-based calculations.

How does the DVLA detect untaxed vehicles?

The DVLA uses Automatic Number Plate Recognition (ANPR) cameras that automatically identify vehicles without valid tax records.

What is a Single Justice Procedure?

It’s a streamlined court process used for minor offences, allowing defendants to respond by post without attending court physically.

How can drivers avoid DVLA fines?

By keeping track of renewal dates, setting reminders, using auto-renewal, and declaring vehicles off-road (SORN) when not in use.